- Authors

- >

- Janine Lennon

Janine Lennon

Head of Payroll Services

Published Articles

Key payroll legislation in the UK for employers

Compliance and staying up to date with what seem like ever-changing regulations is one of the biggest challenges faced by HR and payroll teams in the UK. Even for some of the largest companies in the UK, it can be easy for things to slip through the net. Leaving businesses at risk of facing hefty fines, court cases and even criminal...

What is back pay in the UK?

Back pay is something many of us have likely seen mentioned on a payslip at some point throughout our working lives. The mention of backpay often comes with questions. Usually from employees wondering what it is, why it is written on their pay slip and what it is for. But back pay is rather simple, and it’s not something to worry about. In this...

Payroll challenges for UK small businesses

25% of UK PAYE employees received incorrect payslips this year. That’s research from The Global Payroll Association. That’s one in four workers. The chances are high it’s happening in your business too. Add to those frequent changes to legislation and complex tasks, the challenges of payroll for small businesses start to feel never-ending. Here’s...

Time tracking for accurate payroll processes

To avoid falling through the gaps of failed HMRC compliance and error-filled employee payslips, time tracking procedures are an excellent way to ensure your payroll admin is accurate according to employee hours. Calculate employee hours worked accurately Stay compliant with employment laws and HMRC Eliminate the risks associated with manual data...

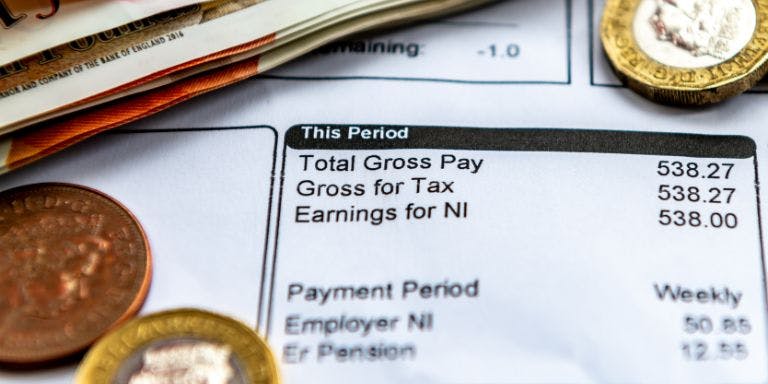

Payslips - everything an employer needs to know

Payslips provide useful information about pay. For your employees, they are ideal for checking that they have been paid correctly, either according to their salary or the hours worked. But they give some insight into other elements of their pay too. As an employer, payslips are an essential element of your payroll process and not only is it your...

How to keep your payroll data secure

Payroll processes are essential for the running of any business, no matter how big or small. These processes include making payroll runs, distributing payslips, and keeping up to date with HMRC payments. Which, in turn, requires the use of sensitive data and private employee information. When it comes to keeping data safe and secure, never has it...